Running a business means dealing with complex electrical systems that keep your operations running smoothly. A commercial electrician is a licensed professional...

Remote education jobs have transformed from a niche opportunity into a thriving career path, with platforms now listing thousands of positions ranging from onli...

Emergency Medical Technicians play a critical role in healthcare systems across the United States, responding to emergencies and providing life-saving care. If ...

Turning 13 opens up new opportunities to earn money and gain valuable work experience, but finding age-appropriate employment requires understanding what option...

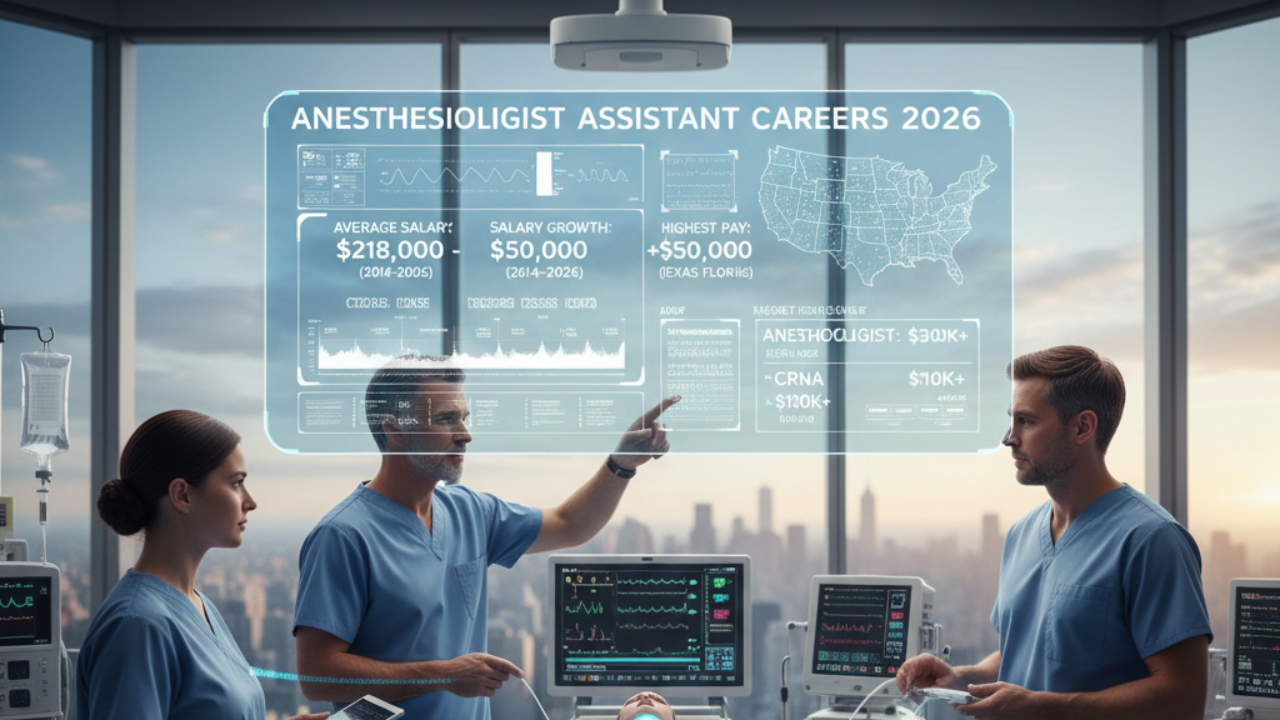

Anesthesiologist assistants play a critical role in surgical teams, working under the supervision of anesthesiologists to ensure patient safety during medical p...

Radiology stands as one of the most financially rewarding medical specialties in the United States. According to recent compensation data, radiologists earn an ...