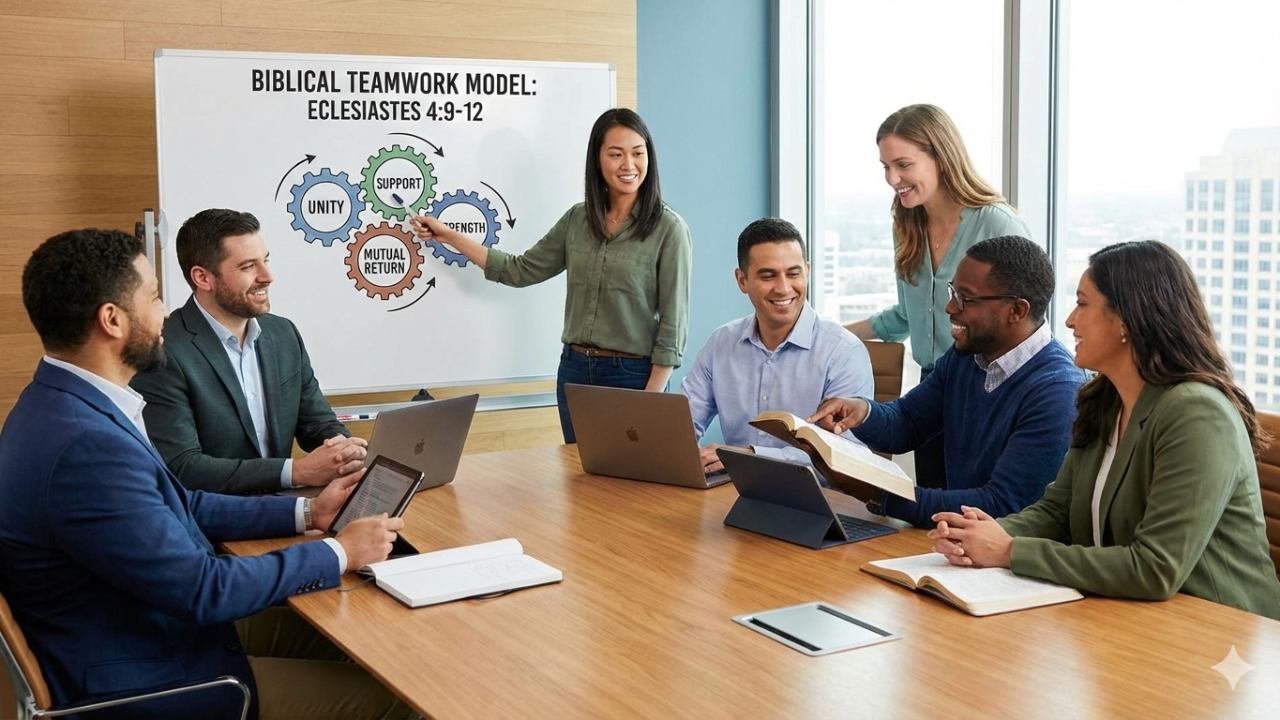

The Bible offers profound guidance on teamwork, emphasizing that we accomplish far more together than alone. Scripture consistently shows that God designed us t...

Organizations face constant pressure to make sound strategic decisions that drive long-term success. The rational approach to strategy formulation is a systemat...

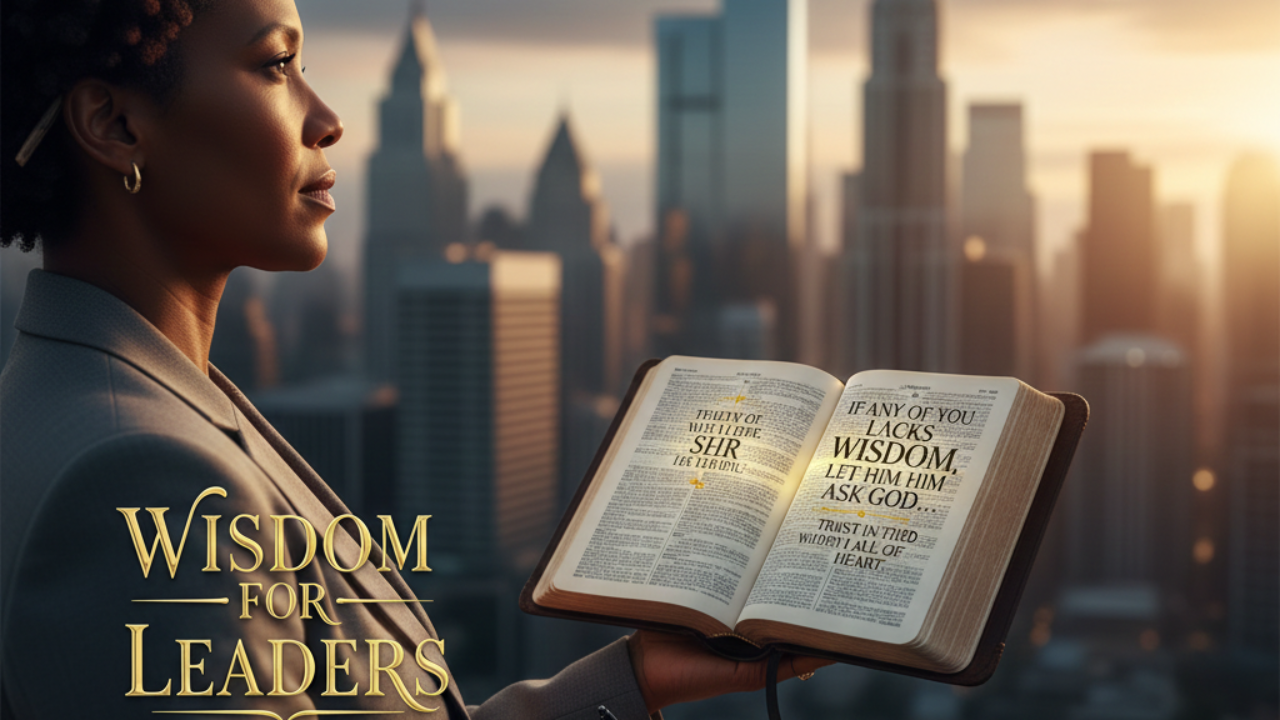

Leadership requires more than just natural ability or experience. The Bible offers timeless wisdom for leaders through verses that emphasize discernment, humili...

"Lead Never Follow Leaders" represents more than just a catchy phrase—it embodies a mindset of independence, authenticity, and self-directed action. This philos...

The question of whether to hyphenate "decision making" confuses many writers, and the answer depends entirely on how you're using the term in your sentence. Whe...

The confusion between "decision making" and "decision-making" trips up writers constantly, but the answer is straightforward. When using the term as a noun, "de...